Understand Your LESCO Bill – Complete Guide to All Taxes and Charges Included in Your LESCO Electricity Bill

Electricity bill is one of biggest concerns for the households in Pakistan especially when the bill amount increases even with low electricity usage. Most of the consumers think that the electricity bill depends on the number of units they consumed but in reality the Lesco bill contains many hidden charges, taxes, adjustments and government duties that increase the total payable amount of your Lesco electricity bill.

Let’s understand your Lesco bill deeply and see what charges are included in your electricity bill. Whether you receive a small bill or a heavy one this guide can help you to understand each tax and why it is included in your Lesco bill.

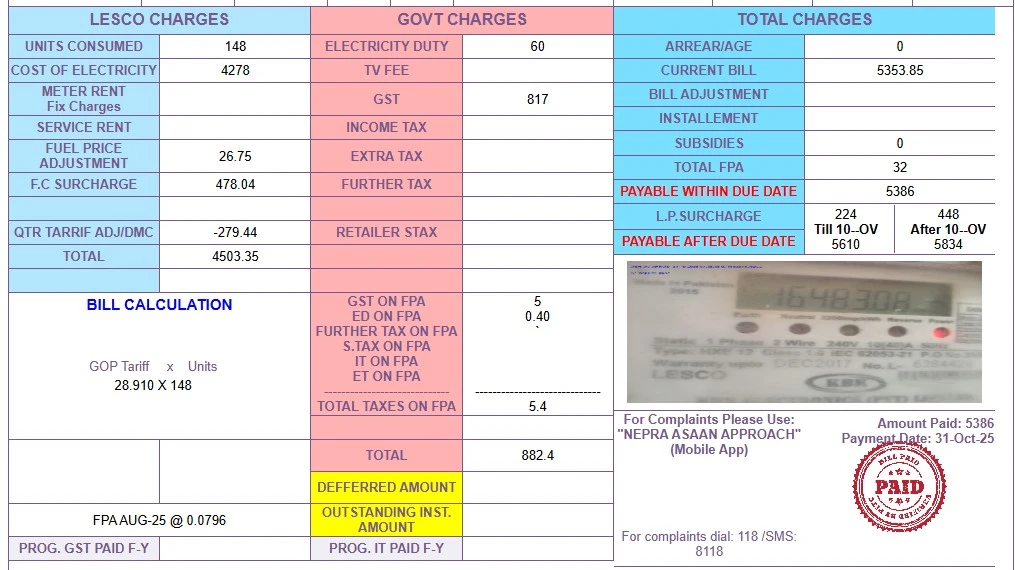

Major Sections of Charges on Your LESCO Bill

Your electricity bill mainly contains two sanctions of charges but there are 13+ different taxes included in your electricity bill.

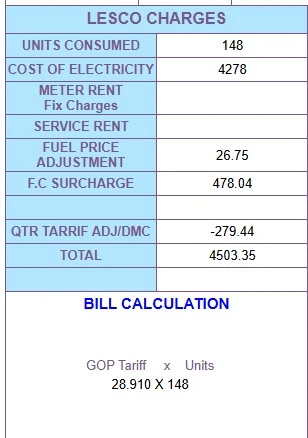

1. LESCO Charges

These are the charges added by LESCO for electricity cost, supply, meter installation, maintenance and tariff adjustments.

2. Government Charges

These are the charges added by the Government of Pakistan. LESCO only collects them and forwards the amount to the government.

The both charges are directly based on unit consumption, tariffs and government decisions but the structure remains the same. Let’s break down each charge one by one.

LESCO Charges Explained in Detail

These charges are directly related to the supply of electricity to your home or shop.

Cost of Electricity

This is the main part of your LESCO bill. It is calculated by multiplying your consumed units with the government-approved tariff rate.

The price per unit is different in each slab:

- 1–100 units → lowest rate

- 101–200 units → medium rate

- Above 200 units → higher rate

Because of slab-based pricing a small increase in units can shift you into a higher slab and it can increase your total bill.

Meter Rent

This is a fixed amount charged by Lesco. This is only charged by the consumers whose meter is on rent. If the consumer has not paid the price of meter he has to pay rent of meter to Lesco.

It remains the same every month regardless of usage.

Service Rent

It is charged by Lesco for system maintenance, technical services and operational support. It is not fixed, it depends on the unit consumed and consumers slab category.

Fuel Price Adjustment

FPA is one of the biggest reasons behind high electricity bills in Pakistan. It is added when the cost of fuel used to generate electricity increases due to:

- International oil prices

- LNG rate changes

- Furnace oil adjustments

It changes every month and applies to units consumed two months ago but charged in a later bill.

F.C Surcharge

This is added by Llesco to support financial losses to the energy sector. Fixed Rate: Rs. 0.43 per unit.

Quarterly Tariff Adjustment (QTR Adj/DMC)

After every 3 months electricity generation costs are reviewed by NEPRA and an adjustment is applied.

This adjustment can be:

- Positive (extra charge)

- Negative (relief)

Because of this your bill may increase or reduce depending on the quarterly review.

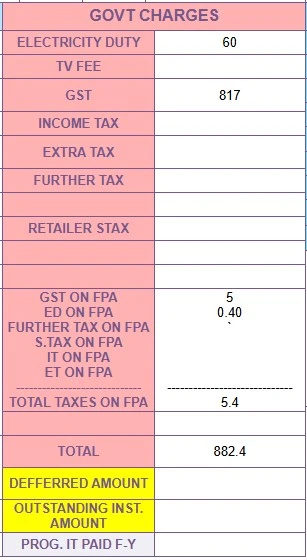

Government Taxes & Duties in LESCO Bill

These taxes are not controlled by LESCO. They are collected on behalf of the Government of Pakistan. These taxes can be 30% to 45% of your electricity consumption bill. Let’s understand these taxes in detail!

Electricity Duty

It is a provincial tax charged by the Punjab government on electricity consumption. Rate: Around 1.5% for domestic users, higher rates for commercial consumers

TV Fee

It is a fixed government fee that funds Pakistan Television (PTV). Amount: Rs. 35 per month, not applied to commercial or industrial meters

GST (General Sales Tax)

GST is usually the biggest tax item in the LESCO bill. It is charged at 17% on the entire taxable amount including

- Cost of electricity

- FPA

- Service charges

- Additional fees

The more your bill grows, the higher your GST becomes.

Income Tax

This tax applies to:

- Non-filers

- Commercial connection holders

- High slab domestic consumers

Filers pay less income tax while non-filers pay more.

Extra Tax

It is applied to consumers who are not registered in the tax system. Rate: 5-10% depending on consumer category.

Further Tax

Additional tax imposed on non-filers on top of GST. Rate: Around 3%.

Retailer Sales Tax (STAX)

Applies only to retailers and shopkeepers with commercial meters. Rate: 5-10% based on meter type.

Taxes on FPA

When FPA is applied, the government also adds micro-taxes on the FPA amount.

These include:

- GST on FPA

- ED on FPA

- Further tax on FPA

- Sales tax on FPA

- Income tax on FPA

- ET on FPA

Deferred Amount and Installments

Sometimes the government allows consumers to defer payment or convert heavy bills into installments. Your bill may show:

- Deferred Amount – Pay now or later

- Outstanding Installments – If previous bills were converted into Easy Installments

These amounts appear only when applicable.

Why Your LESCO Bill Becomes High Even With Low Units?

After researching hundreds of bills and discussing with XEN Engineer Amanullah Sheekh, one thing is clear

Even if your monthly units are low, your bill can become high due to:

High FPA rates

GST (17%)

Quarterly adjustments

Extra taxes for non-filers

Electricity duty

Meter & service charges

This means your “actual electricity cost” is only a part of the total bill. Estimate your lesco bill using lesco bill calculator.

FAQs – Understand Your LESCO Bill

Understand your LESCO bill because more than 13 different taxes and charges can appear on it every month. With clear knowledge, you can better control your usage, manage expectations and track why your bill amount increases.

This guide is prepared with careful research and verified with XEN Engineer Amanullah Sheekh so every consumer can easily understand all taxes included in their LESCO electricity bill.

Your Feedback Matters

I try my best to share correct and helpful information based on my research experience. If you think something is missing or if you want me to add more details about this topic, please share your feedback below. Your suggestions help me improve my content and make this website more useful for everyone. And if you think it is helpful for Lesco consumers please do share post with others.